The Digital Revolution in Tax: Navigating the Future with ARKK

In the rapidly evolving landscape of tax management, the task of staying ahead of regulatory changes while optimising efficiency and accuracy is crucial for businesses. In this article we will delve into the transformative impact of the Making Tax Digital (MTD) initiative, which began its rollout in April 2019 and expanded to all VAT-registered businesses by April 2022. We will also explore how technology, particularly AI (Artificial Intelligence) and machine learning, is reshaping tax functions, debunk myths about job displacement and highlight the immense benefits of increased compliance and risk reduction. Furthermore, this article addresses the growing need for automation software in the ever-evolving in-house tax team, and the key features to look for in a solution. Whether you are navigating the complexities of MTD compliance or seeking to enhance your tax processes, this article offers valuable insights and introduces ARKK’s Automation Platform, a tool that promises to streamline your tax function, mitigate risks, and drive your business forward into the digital age.

Embracing the UK’s MTD Initiative: A Landmark in UK Tax Administration

The MTD initiative, a pivotal move by the UK government, began rolling out in April 2019. This program represented a significant shift in tax administration, mandating the use of digital technology for tax management. Initially targeting VAT-registered businesses above the VAT threshold, MTD set the stage for a broader transformation. By April 2022, this initiative expanded its reach, requiring all VAT-registered businesses to follow MTD rules, marking a new era in the digitisation of tax.

This transition to digital tax management is not just about compliance; it is a significant opportunity for businesses to modernize and streamline their tax functions. The requirement to use compatible software for keeping records and filing returns has accelerated the adoption of technological solutions, leading to more structured, efficient, and error-free tax management processes.

Leveraging AI and Machine Learning: Beyond Compliance

The integration of AI and machine learning into tax functions stands as a transformative development. Far from replacing jobs, AI enhances tax compliance, mitigates risk, and frees up human resources for strategic tasks. Machine learning algorithms analyse vast data sets, identify trends, and predict outcomes, thereby optimizing tax strategies and identifying potential compliance issues.

The Rising Importance of Automation in a Digital Tax Era

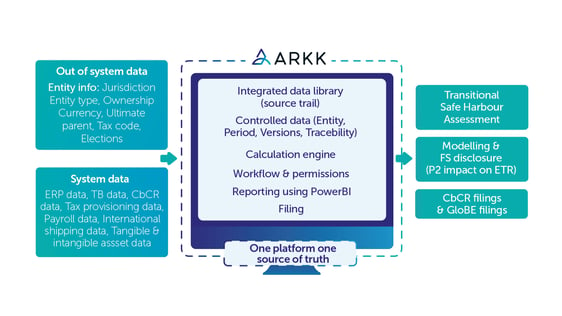

With tax functions becoming increasingly digitalised, the need for effective automation software is more pronounced. Automation streamlines tax processes, minimises manual efforts, and ensures accuracy. ARKK's Automation Platform is a leading solution in this space, offering versatility, advanced AI and machine learning capabilities, and comprehensive data analysis through Power BI integration.

Why the ARKK Automation Platform Stands Out

ARKK's Automation Platform is exceptional for several reasons:

- Data aggregation that is source agnostic: It effortlessly integrates with multiple source systems, making it adaptable to various business models, and removes the need for businesses to provide their data in a specific format.

- AI and Machine Learning Integration: The platform's consistency checker, powered by AI and machine learning, ensures high-quality data output.

- Power BI-Driven Data Analysis: It offers insightful data analysis, with embedded dashboards and reports, for better decision-making.

- Multiple use cases: ARKK does not offer a point-to-point solution, we have configured the advanced technology of the ARKK Automation Platform to support our customers with many outputs such as Pillar Two, Operational Transfer Pricing, PSA, and CESOP to name a few.

We developed our technology with the view to provide our customers with the ability to solve all and any data challenges that lie within their tax functions and to provide a single system that can deliver a truly advanced digital tax management solution.

Conclusion: Embracing a Digitalized Tax Future

The transition to digitalised tax functions is an essential step for modern businesses. Adopting technologies like AI and machine learning is not a threat to employment but an opportunity to enhance efficiency, compliance, and strategic focus.

Now is the time to act. Click below to contact the ARKK team and arrange a demo of the ARKK Automation Platform and transform your tax processes to comply with legislation, reduce risks, and gain strategic advantages. Embrace the digital revolution and position your business for success in an increasingly digitalised world.

%20extra%20canvas%20size+.png?width=290&name=ARKK%20Glyph%20(1500px)%20extra%20canvas%20size+.png)