De-stress

PSA

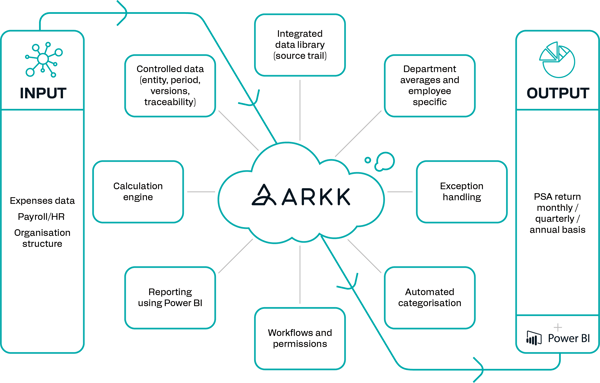

Automate PAYE Settlement

Agreements and never miss

another deadline.

A PAYE Settlement Agreements (PSA) is a voluntary agreement with HMRC that allows employers to make a single annual payment to cover the tax and National Insurance contributions on minor, irregular, or impracticable expenses and benefits for their employees. Items included in the PSA are not required to be reported elsewhere, for example, via the payroll or in the employee’s end-of-year P11D form.

Does it affect me?

If your business provides certain minor and irregular benefits to employees, PSA can help manage the tax due on these efficiently, ensuring compliance with HMRC requirements.

What do I need to do?

You’ll need to identify eligible benefits, ascertain who consumed these benefits and their tax banding, calculate the tax and national insurance owed, and submit a PSA return to HMRC.

What's the deadline?

The deadline for submitting a PSA return is usually 5th July and the deadline for paying the amount due is usually 22nd October after the tax year end. Timely submission and payment is crucial to avoid penalties.

- Bermuda

- Cayman Islands

- Channel Islands

- Czech Republic

- Germany

- Iceland

- Ireland

- Italy

- Luxembourg

- Malta

We're happy to support you wherever you're based. Just speak to one of our experts!

- Netherlands

- Norway

- Sweden

- United Kingdom

- United States

- Europe (inc. 27 EU states)

- North America

- South America

- Africa

- APAC

Save time

Save time

Eliminate the time spent manually categorizing expenses. Focus only on the exceptions that matter, freeing up extra days of capacity within your team.

Maintain compliance

Maintain compliance

Robust audit trails, automated categorization and calculations, and in platform notifications allow you to track progress on your PSA and return.

Increase accuracy

Increase accuracy

Automating repetitive calculations increases accuracy and provides a clear demonstration of how final figures were produced for any future enquiries.

Codify knowledge

Codify knowledge

Encode policies and knowledge related to your PSA return in our secure, cloud-based platform for fast reference and future review.

Cost effective

Cost effective

Avoid overpaying by taking a higher-level approach where taxable expenditure can be overstated, ensuring all reliefs and exemptions are claimed.

Cloud native collaboration

Cloud native collaboration

ARKK’s cloud first approach ensures secure and efficient collaboration, with a platform built from the ground up with security at its core.

The information that came back from ARKK was so clear and transparent.

Kreeson Thatiha, Head of Finance and Client Money, eToro

I was continually reassured of ARKK's technology and their commitment to customer service.

Darryl Alford, Finance Manager, DPD

ARKK were prepared to be more flexible with how we worked and how we were set up.

Alistair McClelland, Head of Tax, The University of Edinburgh

Simply outstanding service and a real pleasure to work with.

Chris Parsons, Production Director, Radley Yeldar

ARKK are extremely responsive and supportive partners.

Janette Moriarty, Group Financial Reporting Director, Kerry Group

ARKK are invaluable to us… I wouldn't consider another project without them.

Valentin Ramousse, Head of International Business Development & Partner, Emperor Works

The speed and accuracy of implementation was incredible.

Akash Kalaiya, EMEA Tax Manager, Universal Weather and Aviation