Lighten the

VAT load

Take the boredom factor out of

VAT reporting with intelligent

AI automation.

Value-Added Tax (VAT) is an indirect consumption tax. It can be complex to calculate due to varying rates, exemptions and VAT groups. Some businesses use Partial Exemption Special Methodologies (PESM), which are bespoke calculations that enable businesses to calculate how much of their input VAT they can recover.

Does it affect me?

About 50% of businesses in the UK are registered for VAT. If a business is VAT registered, you are required to submit VAT returns to HMRC which are compliant with Making Tax Digital for VAT (MTD for VAT) which was introduced in April 2019.

What do I need to do?

MTD for VAT requires business to keep their records digitally and provide a VAT return to HMRC through MTD compatible software monthly, quarterly or annually depending on your registration. Using ‘cut and paste’ or ‘copy and paste’ to select and move information during a VAT process, either within a software program or between software programs is not considered a digital process by HMRC and is not MTD compliant.

What's the deadline?

You should check your VAT return submission and payment deadline in your HMRC online account. As a general rule, the due date to submit and pay VAT returns in the UK is the 7th day of the second month following the reporting period.

- Bermuda

- Cayman Islands

- Channel Islands

- Czech Republic

- Germany

- Iceland

- Ireland

- Italy

- Luxembourg

- Malta

We're happy to support you wherever you're based. Just speak to one of our experts!

- Netherlands

- Norway

- Sweden

- United Kingdom

- United States

- Europe (inc. 27 EU states)

- North America

- South America

- Africa

- APAC

Why choose ARKK?

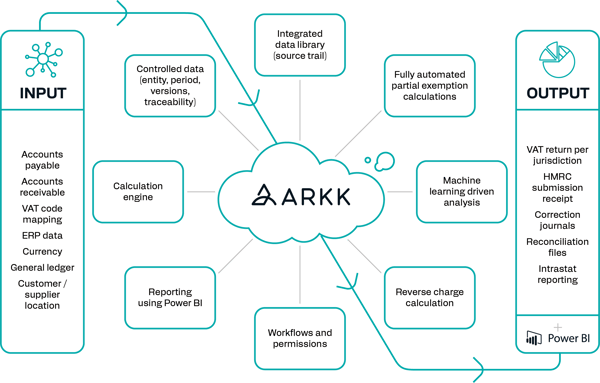

With the ARKK Automation Platform, you're empowered to transform data-heavy activities into a seamless, automated workflow, designed to make your life easier. Tax teams reliant on spreadsheets and basic bridging software for business-critical processes are potentially exposed to risk and are unaware of the unlocked strategic value that an automated solution can offer.

Data aggregation

Data aggregation

The Platform is source agnostic, it uses an advanced engine to aggregate and transform raw data eliminating the need for data manipulation, eliminating errors and saving time.

Error detection

Error detection

Our AI-powered consistency checker finds the “unknown unknowns” by running a line-by-line check on all transactions flagging any inconsistencies.

Automated calculations

Automated calculations

The Platform automates complex and bespoke calculations, including PESM adjustments, ensuring a fully MTD compliant digital journey and submission.

HMRC approved

HMRC approved

Our software is approved by HMRC, with an API connection straight to HMRC for UK VAT filings.

International GST

International GST

ARKK support GST returns in multiple jurisdictions across the globe. The flexibility of the Platform allows us to tailor inputs and outputs to meet your compliance needs.

Comprehensive reporting

Comprehensive reporting

Tailor reports to your needs. The Platform supports multiple outputs including VAT returns for multiple VAT groups or foreign jurisdictions including intrastat reporting.

The information that came back from ARKK was so clear and transparent.

Kreeson Thatiha, Head of Finance and Client Money, eToro

I was continually reassured of ARKK's technology and their commitment to customer service.

Darryl Alford, Finance Manager, DPD

ARKK were prepared to be more flexible with how we worked and how we were set up.

Alistair McClelland, Head of Tax, The University of Edinburgh

Simply outstanding service and a real pleasure to work with.

Chris Parsons, Production Director, Radley Yeldar

ARKK are extremely responsive and supportive partners.

Janette Moriarty, Group Financial Reporting Director, Kerry Group

ARKK are invaluable to us… I wouldn't consider another project without them.

Valentin Ramousse, Head of International Business Development & Partner, Emperor Works

The speed and accuracy of implementation was incredible.

Akash Kalaiya, EMEA Tax Manager, Universal Weather and Aviation