Freshen up

CRD IV reporting

De-stress regulatory compliance

with XBRL and XML conversions

at the click of a button.

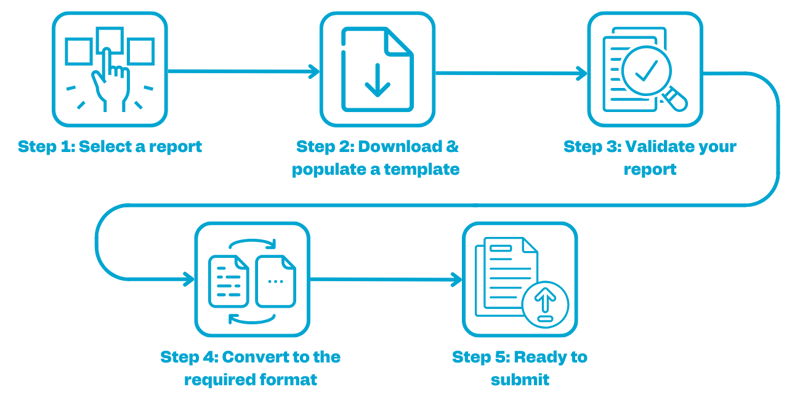

Let our close relationships with regulators lighten your compliance load. Our cloud-based portal makes sure you’re always compliant with the latest reporting requirements by incorporating taxonomy updates, regulatory changes and validations behind the scenes. So there’s no need for you to worry about system updates or software downloads.

The Capital Requirements Directive IV (or CRD IV for short) aims to strengthen the regulation of the banking sector within the European Union (EU). The goal is to enhance the stability and resilience of the financial system through stringent capital requirements, improved risk management, and increased transparency.

Does it affect me?

If you fall into one of the following categories, you may well be in scope:

- EU credit institutions and investment firms

- Non-EU credit institutions operating within the EU

- Entities that are part of a financial conglomerate with significant EU operations.

What do I need to do?

Ensure your firm is fully aware of its obligations under CRD IV. This includes maintaining adequate capital reserves, conducting regular stress tests and adhering to the specified liquidity coverage and leverage ratios. It's essential to follow the European Banking Authority (EBA) guidelines for reporting and compliance. Ensure all relevant data is accurately collected, validated, and reported in accordance with the prescribed formats.

What's the deadline?

If your business is affected, then hopefully you're already complying with the CRD IV requirements. Reporting deadlines can vary based on the type and size of your institution. Quarterly reports are typically due within 45 days of the quarter-end in an XBRL format. It's crucial to stay informed of specific deadlines and requirements that apply to your firm to ensure timely compliance.

- Environmental Social and Governance (ESG)

- Initial Market Valuation for Supervisory Benchmarking Portfolios

- SBP Credit Risk

- SBP Market Risk Measures

- SBP_IFRS9

- Asset Encumbrance

- Additional Liquidity Monitoring – COREP (ALM/ALMM)

- Fundamental Review of the Trading Book – COREP (FRTB)

- LCR Delegated Act – COREP

- Large Exposures – COREP

- Leverage Ratio – COREP

- Stable Funding – COREP (NSFR)

- Own Funds – COREP

- GSII

- Investment Firm Credit Institution Threshold Monitoring

- FINREP Reporting (IFRS9)

- Funding Plans

- Impracticability Notification

- MREL TLAC

- Fraudulent Payments – PSD_FRP

- Resolution

- Initial Market Valuation for Supervisory Benchmarking Portfolios

- Remuneration Benchmarking

- Remuneration on Gender Pay Gap

- Remuneration High Earners

- Remunerations Approved Higher Ratios - Country Level

- Remunerations Approved Higher Ratios - Institution Level

- Interest Rate Risk in the Banking Book (IRRBB)

- Intermediate Parent Undertaking (IPU)

- DORA

- Diversity benchmarking GL

- FICOD

- MiCAR

- Bermuda

- Cayman Islands

- Channel Islands

- Czech Republic

- Germany

- Iceland

- Ireland

- Italy

- Luxembourg

- Malta

We're happy to support you wherever you're based. Just speak to one of our experts!

- Netherlands

- Norway

- Sweden

- United Kingdom

- United States

- Europe (inc. 27 EU states)

- North America

- South America

- Africa

- APAC

Why choose ARKK?

At ARKK, we believe that agile digital tech, plus traditional human expertise, is the perfect combination to ease our customers' compliance burdens. With our scale, experience and can-do attitude in your corner, your business can take the hassle out of intricate and complex regulatory reporting.

Extensive coverage

Extensive coverage

Get the essential reporting solutions at your fingertips, including CRD IV, IFR/IFD, Bank of England, AIFMD, Form PF, Solvency II, CbCR, CBI XBRL and CESOP.

Automated validation

Automated validation

The regulators’ consistency checks are embedded into the ARKK software to ensure compliance with the regulators requirements.

Excel based templates

Excel based templates

Easily link data from existing workbooks to ARKK templates to cut the time it takes to prepare your reports to the absolute minimum.

Award winning support

Award winning support

Our team is here to deliver the latest taxonomy information and fix any errors. Extra hours and short SLAs are available around reporting deadlines.

Cut errors with roll-forward

Cut errors with roll-forward

No more re-keying data into new templates. This handy feature saves time and reduces the risk of mistakes creeping into each submission.

Secure cloud-based portal

Secure cloud-based portal

Our ISO 27001 certified portal gives you access to a single and secure destination for uploading, tracking, and accessing your files.

The information that came back from ARKK was so clear and transparent.

Kreeson Thatiha, Head of Finance and Client Money, eToro

I was continually reassured of ARKK's technology and their commitment to customer service.

Darryl Alford, Finance Manager, DPD

ARKK were prepared to be more flexible with how we worked and how we were set up.

Alistair McClelland, Head of Tax, The University of Edinburgh

Simply outstanding service and a real pleasure to work with.

Chris Parsons, Production Director, Radley Yeldar

ARKK are extremely responsive and supportive partners.

Janette Moriarty, Group Financial Reporting Director, Kerry Group

ARKK are invaluable to us… I wouldn't consider another project without them.

Valentin Ramousse, Head of International Business Development & Partner, Emperor Works

The speed and accuracy of implementation was incredible.

Akash Kalaiya, EMEA Tax Manager, Universal Weather and Aviation